How to fill out a 1040 form means reporting your income, credits, and taxes accurately on IRS Form 1040 to calculate what you owe or the refund you may receive.

Filing taxes does not need to feel like decoding an ancient scroll. If you understand the structure and purpose of IRS Form 1040, the process becomes logical, manageable, and even predictable. This guide walks you through every step using verified IRS information, real-world logic, and plain English. No fluff. No fear tactics. Just facts and clarity.

At BooksMerge, we help individuals and businesses simplify tax filing through accurate bookkeeping, taxation, and compliance support. When you understand your tax return, you stay in control of your finances.

Table of Contents

What Is 1040 Tax Form

Who Should File IRS Form 1040

Documents You Need Before You Start

Understanding the Structure of Form 1040

Step-by-Step Guide on How to Fill Out a 1040 Form

Income Section Explained

Adjustments, Credits, and Taxes

Schedule B Form 1040 Explained

Form 1040 Schedule 3 Explained

Completed 1040 Form Example PDF

What Is the 1040-NR Form

Common Mistakes to Avoid

Filing and Payment Options

Conclusion

FAQs

What Is 1040 Tax Form

The IRS Form 1040 is the official U.S. individual income tax return. It explains how to fill out a 1040 form by showing how the Internal Revenue Service calculates your federal tax owed or the refund you may receive.

According to the IRS, most U.S. citizens and resident aliens use Form 1040 to report wages, interest, dividends, business income, and credits. It also replaced older filing forms like 1040A and 1040EZ, making tax reporting more streamlined.

Who Should File IRS Form 1040

You should file IRS Form 1040 if you:

Earned income above IRS filing thresholds

Received self-employment income

Want to claim tax credits or refunds

Paid federal taxes during the year

The IRS updates income limits yearly. Always confirm with the latest IRS guidelines.

Documents You Need Before You Start

Preparation saves time and reduces errors. Gather these first:

W-2 forms from employers

1099 forms for freelance or interest income

Social Security numbers

Last year’s tax return

Bank account details for direct deposit

This step alone prevents most filing mistakes.

Understanding the Structure of Form 1040

Form 1040 has three main sections:

Income

Adjustments and Credits

Tax, Payments, and Refund

Each section flows logically. If you follow the order, the form practically guides you.

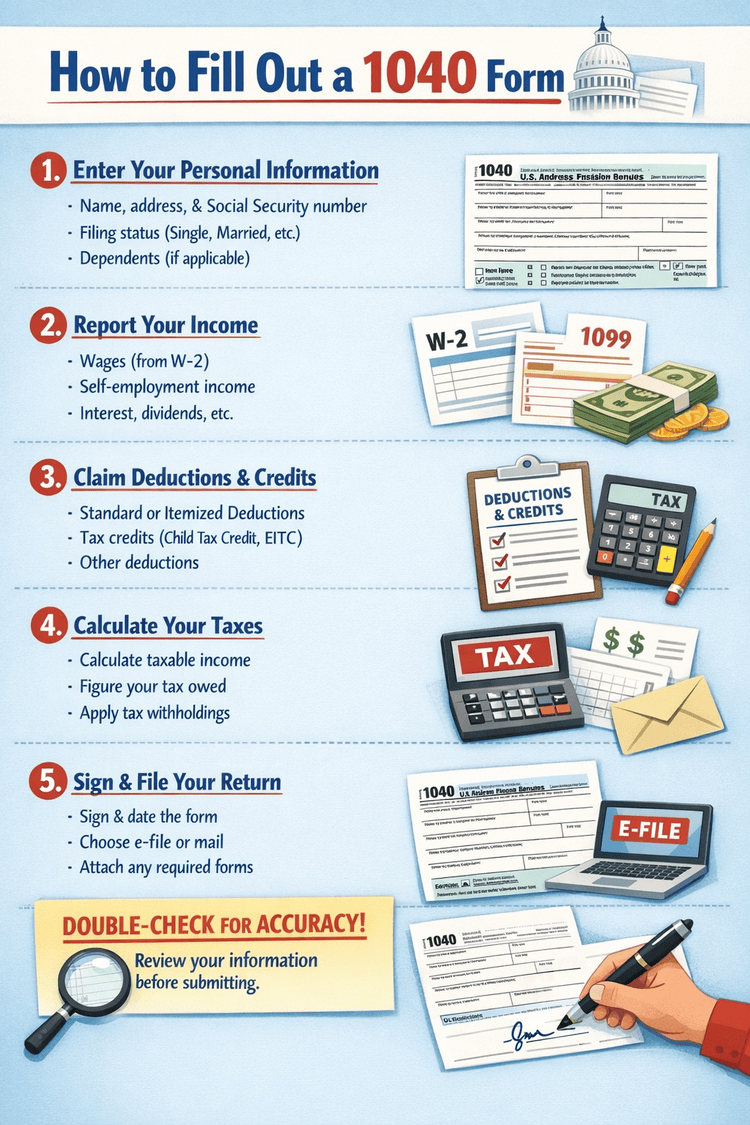

Step-by-Step Guide on How to Fill Out a 1040 Form

Step 1: Personal Information

Enter your name, Social Security number, filing status, and address. Accuracy matters here. One wrong digit can delay processing.

Step 2: Choose Your Filing Status

Select one:

Single

Married filing jointly

Married filing separately

Head of household

Qualifying surviving spouse

Your status affects tax rates and deductions.

Income Section Explained

This section reports how much money you made.

Common income sources include:

Wages from Form W-2

Interest income

Dividends

Business income

Retirement distributions

The IRS cross-checks this data with reported forms. Honesty is not optional.

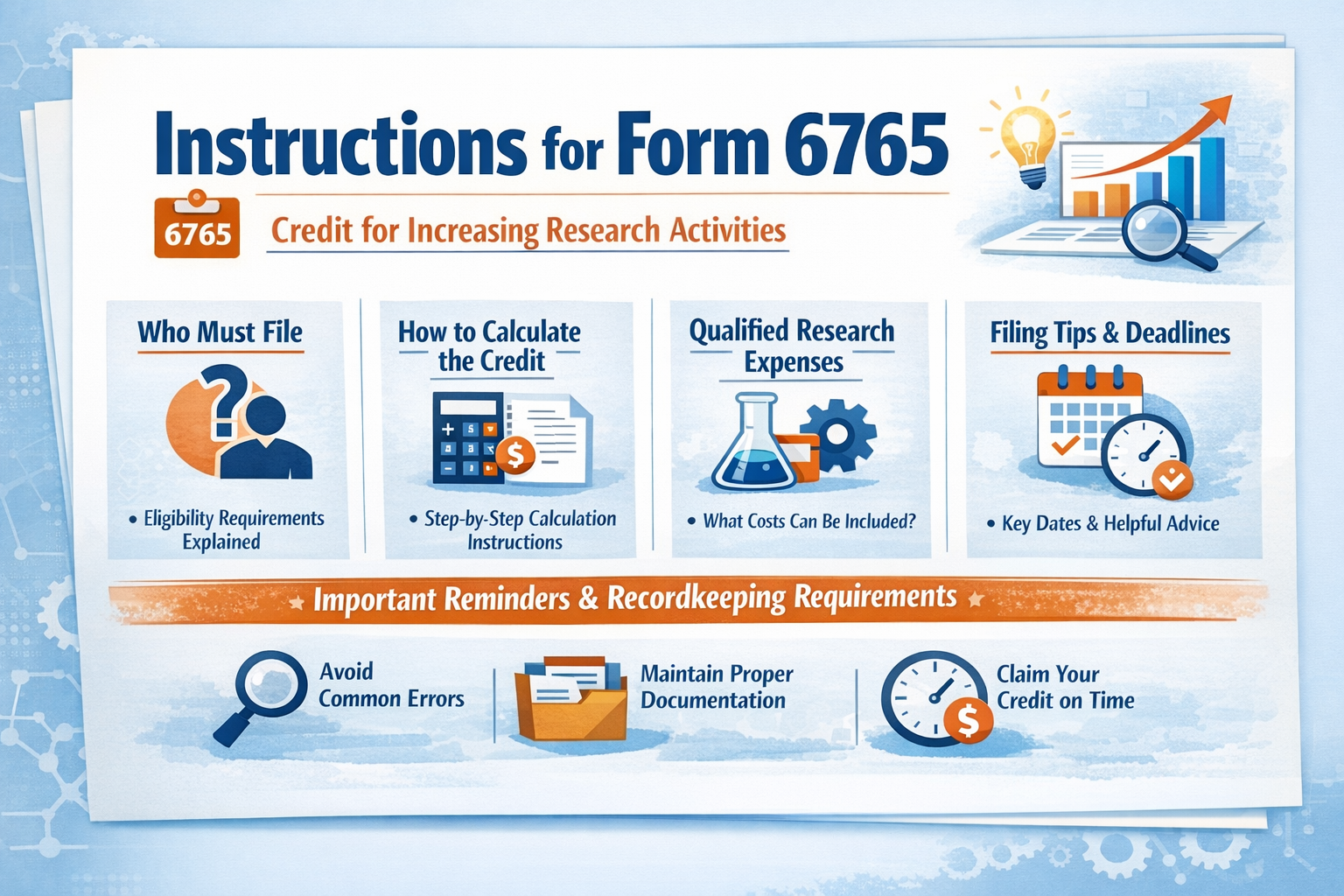

Quick Note: Form 6765 Instructions explain how to properly claim the IRS Research and Development tax credit by reporting qualified research expenses and calculating eligible tax benefits step by step.

Adjustments, Credits, and Taxes

After income, you subtract eligible adjustments. These include:

IRA contributions

Student loan interest

Next, apply tax credits. Credits reduce tax dollar for dollar. Examples include:

Child Tax Credit

Education credits

Then calculate total tax owed.

Schedule B Form 1040 Explained

Schedule B Form 1040 reports interest and ordinary dividends over $1,500.

You must file Schedule B if:

You earned interest or dividends above IRS limits

You have foreign accounts

Skipping Schedule B when required can trigger IRS notices.

Form 1040 Schedule 3 Explained

Form 1040 Schedule 3 reports nonrefundable and refundable credits not listed directly on Form 1040.

Common items include:

Foreign tax credit

Education credits

General business credits

Schedule 3 flows directly into your total tax calculation.

Completed 1040 Form Example PDF

The IRS provides a completed 1040 form example PDF within official instructions. Reviewing it helps you visualize proper placement of numbers and signatures.

You can find verified examples directly on the IRS website under Form 1040 resources.

What Is the 1040-NR Form

The 1040-NR form applies to nonresident aliens who earn U.S.-sourced income.

It differs from the standard Form 1040 in:

Filing status options

Allowed deductions

Tax treaty benefits

Nonresident taxpayers should review IRS Publication 519 for accurate filing.

Common Mistakes to Avoid

Avoid these frequent errors:

Misspelled names

Incorrect Social Security numbers

Math miscalculations

Missing signatures

Forgetting schedules

Tax software reduces errors, but human review still matters.

Filing and Payment Options

You can file:

Electronically through IRS Free File

Through authorized tax software

By mail

For payments, options include:

Direct debit

Credit or debit card

IRS payment plans

If you need help, BooksMerge provides professional tax filing support. You can reach our team at +1-866-513-4656 for reliable assistance.

Conclusion

Learning how to fill out a 1040 form empowers you. The form follows logic, not mystery. When you understand each section, tax filing becomes a task, not a threat. With proper preparation, verified IRS resources, and expert support, you stay compliant and confident.

At BooksMerge, we believe informed taxpayers make better financial decisions. Accuracy today prevents stress tomorrow.

Frequently Asked Questions

What is 1040 tax form used for?

IRS Form 1040 reports income, deductions, credits, and taxes owed or refunded to individual taxpayers.

Can I file Form 1040 myself?

Yes. Many taxpayers file independently using IRS Free File or tax software, as long as their situation remains straightforward.

Do I need Schedule B with Form 1040?

You need Schedule B if your interest or dividend income exceeds IRS thresholds or if you have foreign accounts.

Is 1040-NR different from Form 1040?

Yes. The 1040-NR form applies to nonresident aliens and follows different tax rules and deductions.

Where can I find a completed 1040 form example PDF?

The IRS provides official examples within Form 1040 instructions on its website.

Read Also: Form 6765 Instructions

Write a comment ...