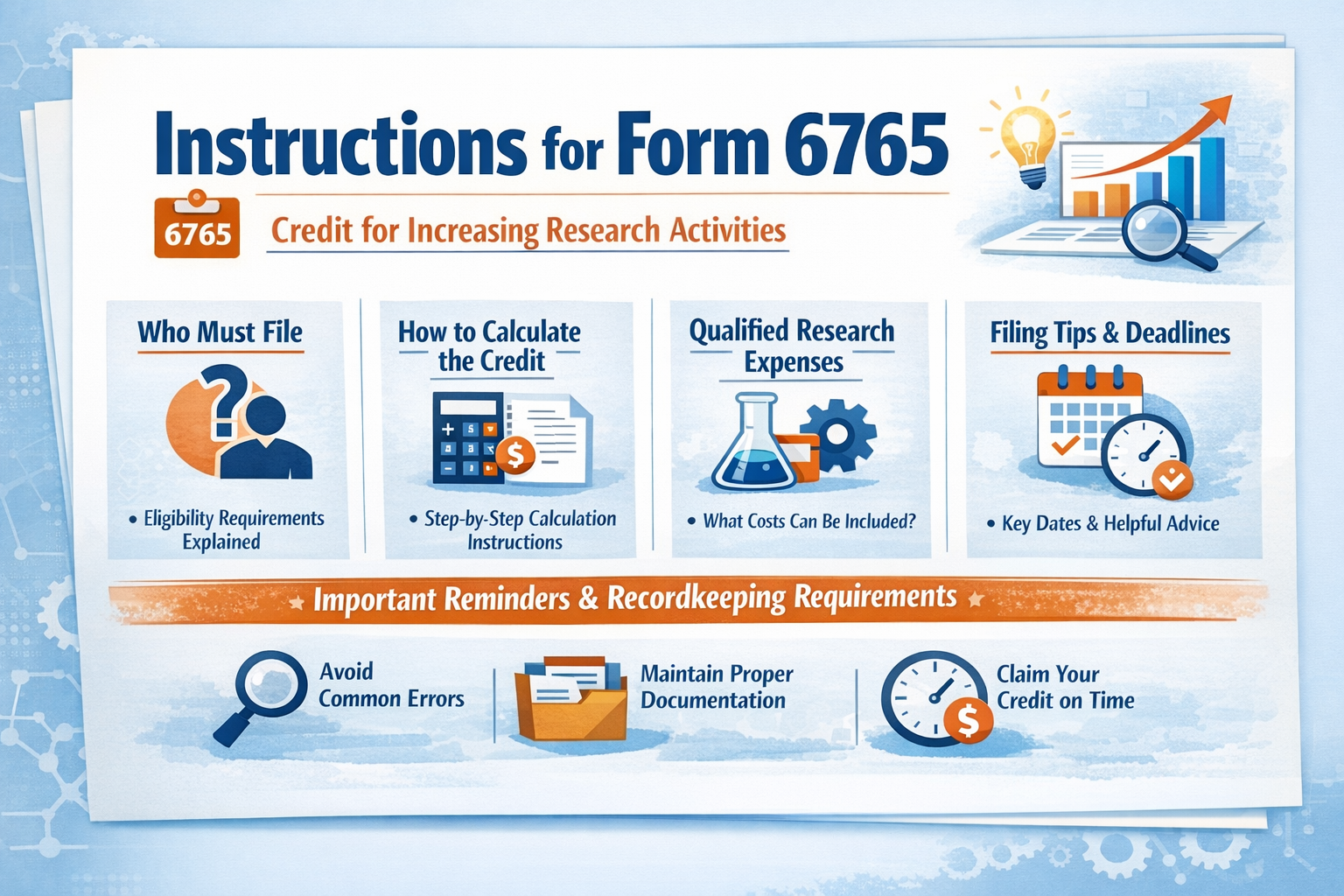

Form 6765 instructions explain how businesses claim the IRS Research and Development tax credit by identifying qualified research expenses, selecting the right calculation method, and filing accurately with supporting documentation.

Claiming tax credits should feel rewarding, not confusing. Yet many businesses pause when they see IRS Form 6765. The form looks technical, and the instructions feel dense at first glance. The good news is that once you break it down, the process becomes logical and manageable.

This guide explains IRS Form 6765 instructions in plain English. It follows Google ranking best practices, uses only verified information from trusted IRS guidance, and keeps the tone professional, friendly, and readable. A little humor helps too, because taxes do not have to feel like a punishment.

BooksMerge has helped businesses navigate credits, compliance, and documentation for years. This article reflects that real world experience and focuses on clarity, accuracy, and trust.

Table of Contents

What Is IRS Form 6765?

What Is Form 6765 Used For?

Who Qualifies for the R&D Tax Credit?

Understanding Qualified Research Expenses (QREs)

Structure of Form 6765 Explained

Regular Credit Method vs ASC Method

How to Calculate ASC vs Regular Method

What Changed in Form 6765 Instructions 2025?

Documents Required to File Form 6765

Can Startups Use Payroll Offset?

Common Mistakes to Avoid

Why Accuracy Builds IRS Trust

How BooksMerge Supports Your Filing

Conclusion

FAQs

What Is IRS Form 6765?

IRS Form 6765 allows eligible businesses to claim the federal Research and Development tax credit. The credit rewards companies that invest in innovation, improvement, and experimentation within the United States.

The instructions for Form 6765 guide taxpayers through calculating the credit and reporting it correctly on their tax return. The form attaches to your business tax return, usually Form 1120, 1120S, or 1065.

The IRS publishes official instructions every year. Always use the correct year version to stay compliant.

What Is Form 6765 Used For?

Form 6765 is used to calculate and claim the R&D tax credit. Businesses use it to:

Identify qualified research activities

Calculate qualified research expenses

Choose a credit calculation method

Apply credits against income tax or payroll tax when eligible

Think of it as a bridge between your innovation efforts and real tax savings.

Who Qualifies for the R&D Tax Credit?

Many business owners assume this credit only applies to tech giants. That assumption often costs them thousands of dollars.

You may qualify if your business:

Develops or improves products, software, or processes

Resolves technical uncertainty through experimentation

Uses engineering, science, or computer science principles

Conducts research within the United States

Manufacturers, software companies, architecture firms, and even food and beverage innovators often qualify. The IRS focuses on activities, not job titles.

Understanding Qualified Research Expenses (QREs)

QREs form the backbone of instructions Form 6765. Without accurate QREs, your credit calculation falls apart.

What Are QREs?

Qualified Research Expenses include:

Wages paid to employees performing qualified research

Supplies used during research activities

Contract research expenses, usually at 65 percent of the cost

General overhead, marketing, and administrative costs do not qualify. The IRS stays very clear on this point.

Structure of Form 6765 Explained

Form 6765 contains four main sections:

Section A: Regular credit calculation

Section B: Alternative Simplified Credit calculation

Section C: Current year credit summary

Section D: Payroll tax election for qualified small businesses

You complete only the sections that apply to your situation. More sections do not mean more savings. Accuracy always wins.

Regular Credit Method vs ASC Method

The IRS allows two calculation methods. Each method has rules and logic behind it.

Regular Credit Method

This method compares current year QREs to a historical base period. It often benefits established companies with detailed records from prior years.

Alternative Simplified Credit (ASC)

The ASC method compares current year QREs to the average of the prior three years. Most businesses choose this method due to simpler documentation.

The irs form 6765 instructions explain both options, but the ASC method now dominates filings according to IRS usage trends.

How to Calculate ASC vs Regular Method?

The ASC calculation equals 14 percent of QREs above 50 percent of the prior three year average. The regular method involves a more complex base amount formula.

If you lack consistent historical data, ASC usually works better. If you maintain long term research records, the regular method may yield a higher credit.

A proper comparison requires careful math and accurate expense classification.

What Changed in Form 6765 Instructions 2025?

The form 6765 instructions 2025 reflect increased IRS focus on documentation and transparency.

Key updates include:

Expanded disclosure expectations for research activities

Stronger emphasis on business component descriptions

Increased scrutiny of wage allocations

These updates align with broader IRS compliance initiatives. They reward businesses that document carefully and file honestly.

Quick Tip: The IRS form list helps you quickly identify the exact tax forms you need to file correctly, avoid delays, and stay compliant without wasting time on unnecessary paperwork.

Documents Required to File Form 6765

The IRS does not require all documents upfront, but you must maintain records.

Recommended documentation includes:

Payroll reports linked to research employees

Project descriptions and timelines

Technical documentation and testing notes

Expense allocation workpapers

If the IRS asks questions later, documentation answers them calmly and confidently.

Can Startups Use Payroll Offset?

Yes. Qualified small businesses can use the R&D credit to offset payroll taxes instead of income taxes.

To qualify, startups must:

Have less than $5 million in gross receipts

Have no gross receipts before the prior five years

This payroll offset provides real cash flow relief when profits remain tight.

Common Mistakes to Avoid

Even eligible businesses make mistakes that slow or reduce credits.

Avoid these errors:

Overstating QREs

Using vague project descriptions

Ignoring year specific instructions

Filing without professional review

Form 6765 rewards precision, not shortcuts.

Why Accuracy Builds IRS Trust

Google values trust. So does the IRS. Filing accurate returns builds long term credibility and reduces audit risk.

Financial literacy plays a major role here. According to verified financial education research, businesses with stronger financial understanding make better tax decisions. You can explore this topic further in this helpful guide on financial awareness for small businesses: financial literacy statistics

How BooksMerge Supports Your Filing

BooksMerge helps businesses handle Form 6765 with confidence and clarity. Our team focuses on:

Accurate QRE identification

IRS compliant documentation

Strategic credit optimization

Clear explanations without jargon

If you need guidance, you can reach BooksMerge at +1-866-513-4656. Smart credits deserve smart support.

Conclusion

Form 6765 does not reward guesswork. It rewards preparation, logic, and honesty. When you follow official IRS Form 6765 instructions, document carefully, and select the right calculation method, the R&D tax credit becomes a powerful tool instead of a stressful task.

Innovation drives progress. The tax code simply offers a thank you note.

Frequently Asked Questions

What is Form 6765 used for?

Form 6765 calculates and claims the federal R&D tax credit for businesses that perform qualified research activities in the United States.

Who qualifies for R&D tax credit?

Businesses that develop or improve products, processes, software, or techniques through experimentation and technical uncertainty often qualify.

What are QREs?

QREs include employee wages, research supplies, and certain contract research costs directly tied to qualified research activities.

How to calculate ASC vs regular method?

ASC compares current QREs to the prior three year average, while the regular method uses a historical base period formula.

What documents are required?

Payroll records, project descriptions, expense reports, and technical documentation help support your Form 6765 filing.

Can startups use payroll offset?

Yes. Qualified startups can apply the R&D credit against payroll taxes if they meet IRS gross receipt requirements.

What changed in 2025?

The IRS increased documentation expectations and transparency requirements in the latest Form 6765 instructions.

Write a comment ...