The 1040 tax form is the official IRS form used by U.S. taxpayers to report income, claim deductions, and calculate taxes or refunds. Correct filing ensures accuracy, compliance, and potential refunds.

At BooksMerge, we provide guidance for individuals and businesses to file confidently. Call +1-866-513-4656 for expert assistance.

Table of Contents

What is 1040 Tax Form?

Who Should File IRS Form 1040?

Documents Needed Before Filing

Step-by-Step Guide: How to Fill Out a 1040 Form

Understanding Form 1040 Schedule 3

Schedule B Form 1040 Explained

Filing 1040-NR Form for Nonresidents

Completed 1040 Form Example PDF

Tax Price and Professional Filing Options

Common Mistakes to Avoid

Why Choose BooksMerge

Conclusion

FAQs

What is 1040 Tax Form?

The 1040 tax form is the primary federal income tax return for U.S. taxpayers. It allows individuals to report income from wages, dividends, interest, self-employment, and other sources while applying deductions and credits to calculate taxes owed or refunds.

Learning how to fill out a 1040 form is crucial. Mistakes may delay refunds or trigger IRS notices, making accurate filing essential for peace of mind.

Who Should File IRS Form 1040?

You should file IRS Form 1040 if you:

Earned income above IRS thresholds

Had federal taxes withheld

Want to claim refundable credits

Are self-employed or owe additional taxes

Even if not required, filing may allow you to claim refunds or credits. At BooksMerge, we make sure you don’t miss opportunities.

Documents Needed Before Filing

Gather the following documents before filling out your 1040:

W-2 forms from employers

1099 forms for freelance, interest, or dividend income

Social Security numbers for you and dependents

Last year’s tax return

Bank account info for direct deposit

Having all documents ready saves time, prevents mistakes, and makes filing easier.

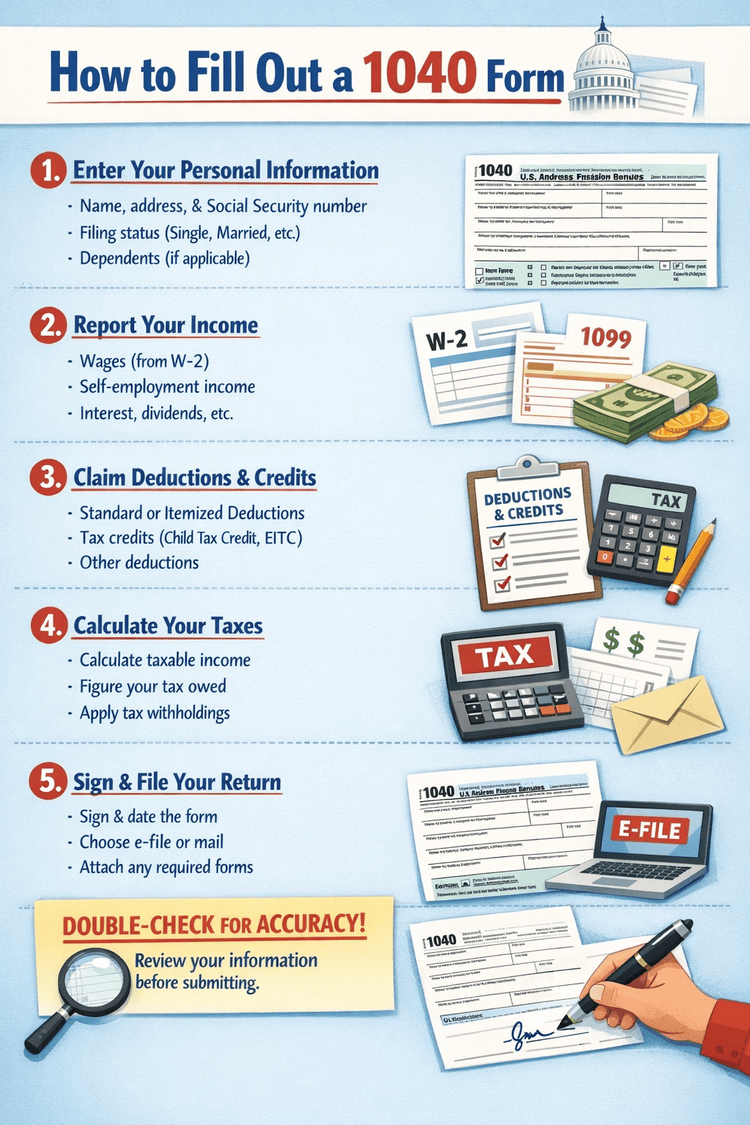

Step-by-Step Guide: How to Fill Out a 1040 Form

Filing IRS Form 1040 becomes simpler when approached methodically.

1. Personal Information

Enter your full name, address, Social Security number, and filing status. Your filing status affects tax brackets, deductions, and credits.

2. Income Section

Include all income sources:

Wages and salaries

Interest and dividends

Business income

Retirement distributions

Accuracy is critical. The IRS cross-checks reported income with employers and financial institutions.

3. Adjustments to Income

Adjustments reduce taxable income. Common adjustments include:

IRA contributions

Student loan interest

Educator expenses

4. Standard Deduction or Itemized Deductions

Choose between the standard deduction or itemizing if your expenses exceed the standard deduction.

5. Tax and Credits

Calculate your tax liability using IRS tables. Include credits reported on form 1040 schedule 3 to reduce the amount owed.

6. Payments and Refund

Enter withholding and estimated payments. The form calculates whether you owe taxes or qualify for a refund.

Understanding Form 1040 Schedule 3

Form 1040 Schedule 3 reports additional credits not listed on the main 1040, such as:

Foreign tax credit

Education credits

General business credits

Many taxpayers miss Schedule 3, which can result in overpaying taxes. Accurate reporting ensures you maximize your refund.

Quick Tip: Keep an updated IRS form list handy to easily find the right forms, save time, and avoid mistakes during tax filing season.

Schedule B Form 1040 Explained

Schedule B Form 1040 is required if you have:

Interest or ordinary dividends over $1,500

Foreign accounts or trusts

Leaving it out can trigger IRS notices, so review your investments carefully.

Filing 1040-NR Form for Nonresidents

The 1040-NR form is for nonresident aliens earning U.S.-sourced income, including international students, visiting researchers, or foreign professionals.

It only reports U.S.-sourced income. Filing rules differ from residents, so professional guidance is recommended.

Completed 1040 Form Example PDF

A completed 1040 form example PDF helps visualize how to correctly fill out each section. Reviewing examples reduces mistakes and improves filing accuracy.

Tax Price and Professional Filing Options

The tax price for filing a 1040 form varies by complexity:

Simple returns: minimal cost

Returns with business, investments, or multiple deductions: higher complexity

At BooksMerge, we provide transparent pricing and professional assistance. Call +1-866-513-4656 for a personalized quote. Accurate filing saves money and prevents penalties.

Common Mistakes to Avoid

Incorrect Social Security numbers

Missing signatures

Omitting Schedule B Form 1040 or Form 1040 Schedule 3

Math errors

Choosing the wrong filing status

Following IRS Form 1040 instructions ensures you claim all deductions and credits without mistakes.

Why Choose BooksMerge

BooksMerge specializes in accounting, bookkeeping, taxation, payroll, and data migration. Our experts:

Follow IRS guidelines precisely

Ensure correct schedule and form filing

Maximize refunds and minimize liabilities

Provide friendly step-by-step guidance

Call +1-866-513-4656 to get professional assistance and peace of mind while filing your 1040.

Conclusion

Filing a 1040 form correctly helps you claim all eligible deductions, credits, and ensures compliance with the IRS. Proper documentation, careful calculations, and expert guidance from BooksMerge make filing accurate and stress-free.

FAQs

What is 1040 tax form?

The 1040 form is the main federal tax return for reporting income, deductions, credits, and calculating taxes or refunds.

Do I need Schedule B Form 1040?

Yes, if your interest or dividends exceed $1,500 or you hold foreign accounts.

What is Form 1040 Schedule 3?

Schedule 3 reports additional credits not included on the main 1040 form, such as education or business credits.

Can nonresidents file 1040?

Nonresidents must use 1040-NR to report U.S.-sourced income.

Where can I see a completed 1040 form example PDF?

Official IRS examples are available online. Professional guidance from BooksMerge ensures accuracy.

How much does it cost to file 1040?

The tax price depends on complexity. Call +1-866-513-4656 for a personalized quote.

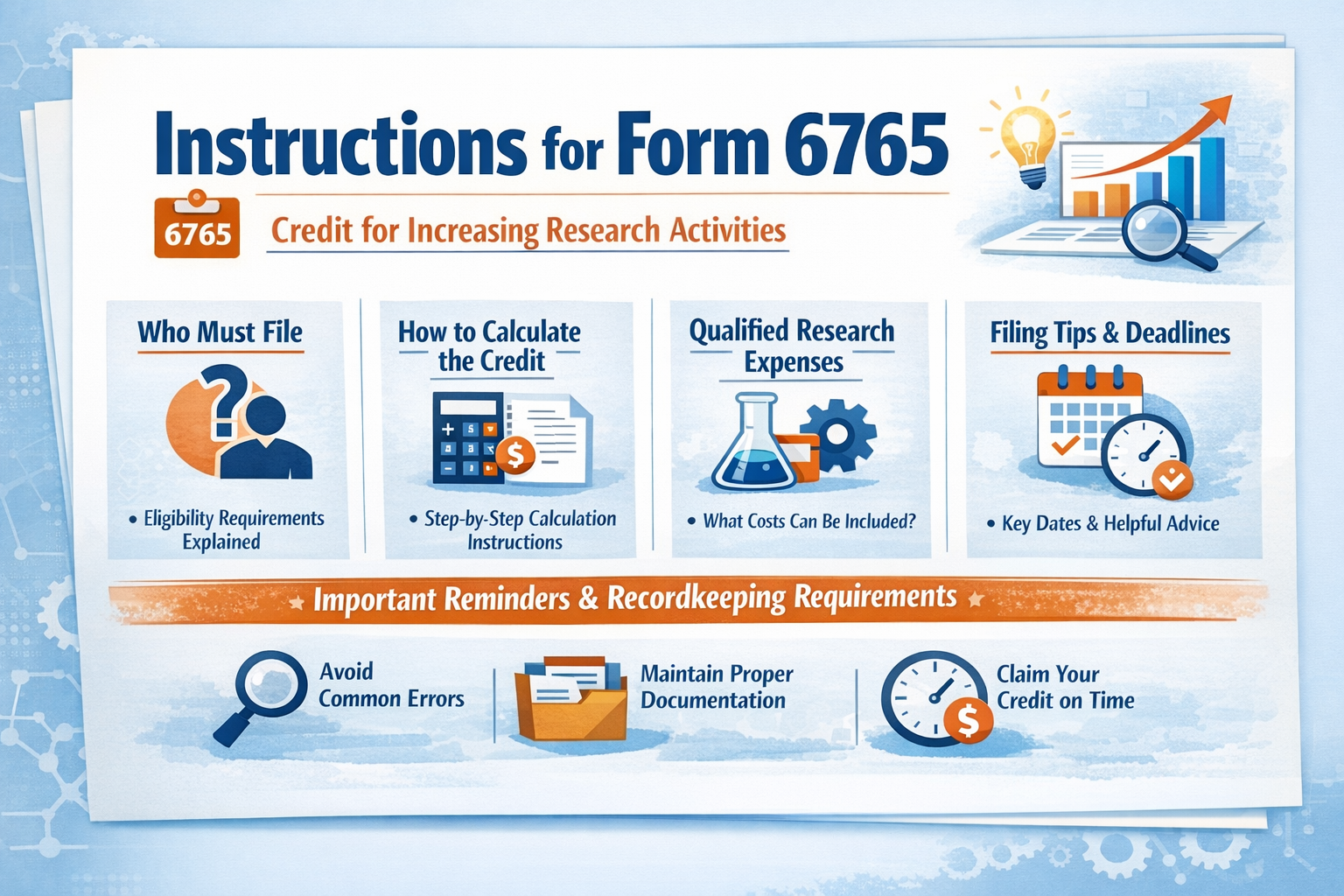

Read Also: Form 6765 Instructions

Write a comment ...