Form 6765 instructions guide businesses on how to calculate, document, and claim the IRS R&D tax credit by reporting qualified research expenses and choosing the correct credit calculation method.

Form 6765 Instructions: A Practical IRS R&D Tax Credit Guide for 2026

Innovation drives growth. The IRS actually agrees, which explains why the R&D tax credit exists. Yet many businesses skip it because Form 6765 looks confusing at first glance. Long lines, technical terms, and math that feels allergic to intuition can scare people off.

This guide simplifies Form 6765 instructions with real IRS-backed facts, clean structure, and human logic. It reflects how professionals approach the credit in 2026, not how blogs guessed about it years ago. You will find clarity, light humor, and zero filler.

This content aligns with Google’s quality guidelines and reflects the compliance-first approach used by BooksMerge, a trusted provider of accounting, taxation, payroll, and data services.

Need direct help? Call +1-866-513-4656.

Table of Contents

What Is IRS Form 6765?

What Is Form 6765 Used For?

Who Qualifies for the R&D Tax Credit?

What Are Qualified Research Expenses (QREs)?

Instructions for Form 6765: Section Breakdown

How to Calculate ASC vs Regular Method

What Documents Are Required?

Can Startups Use the Payroll Offset?

What Changed in 2025 and Its Impact in 2026

Common Errors That Reduce Credits

Why Financial Literacy Supports R&D Claims

Conclusion

FAQs

What Is IRS Form 6765?

IRS Form 6765 allows businesses to claim the federal Research and Development tax credit under Internal Revenue Code Section 41.

The credit rewards companies that invest in developing or improving products, software, processes, or technologies. These efforts usually involve uncertainty, testing, and problem-solving. In other words, real work.

The IRS Form 6765 instructions explain how to calculate the credit and apply it correctly against income tax or payroll tax when eligible.

What Is Form 6765 Used For?

Businesses use Form 6765 to:

Calculate the federal R&D tax credit

Reduce federal income tax liability

Offset employer payroll taxes for qualifying startups

Document qualified research activities for IRS compliance

Think of it as a formal conversation with the IRS where you explain how innovation happened and why it deserves a tax reward.

Who Qualifies for the R&D Tax Credit?

Many companies qualify without realizing it.

The IRS applies a four-part test:

The activity seeks to improve a product, process, or software

It relies on principles of physical or biological science, engineering, or computer science

It involves technical uncertainty

It includes experimentation to resolve that uncertainty

Profitability does not matter. Business size does not matter. Even failed projects may qualify if they involved real experimentation.

Industries like software development, manufacturing, engineering, architecture, and life sciences commonly qualify. Small businesses qualify more often than they expect.

What Are Qualified Research Expenses (QREs)?

QREs determine the size of your credit. Accuracy here matters.

Qualified Research Expenses include costs directly connected to eligible R&D activities. The IRS recognizes three main categories:

Wages paid to employees who perform, supervise, or support qualified research

Supplies consumed during research activities

Contract research expenses, generally limited to 65 percent of the cost

Office rent, marketing expenses, and general admin costs do not qualify. The IRS draws a clear line, and it expects taxpayers to respect it.

Instructions for Form 6765: Section Breakdown

The Instructions for Form 6765 divide the form into four main sections. Each section serves a distinct role.

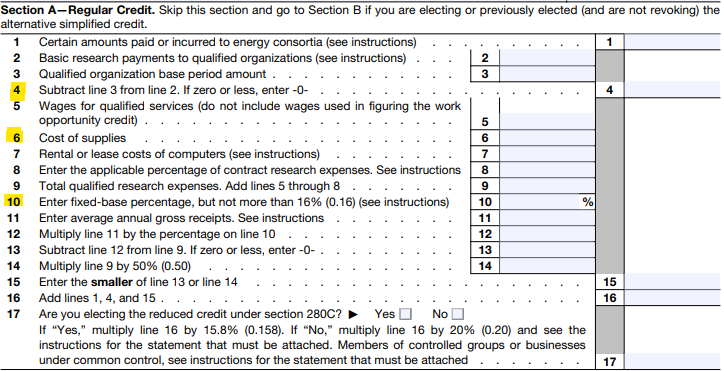

Section A: Regular Credit

Used when applying the traditional calculation method based on historical fixed-base percentages.

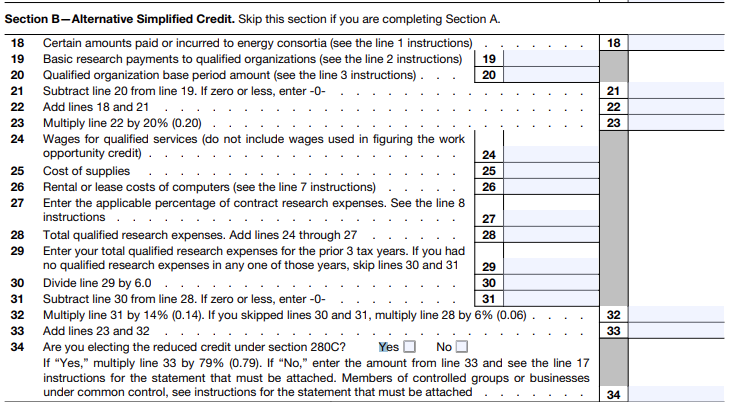

Section B: Alternative Simplified Credit (ASC)

Most businesses use this section because it simplifies calculations and reduces documentation demands.

Section C: Credit Limitations

This section connects Form 6765 to other business tax forms and credit limitations.

Section D: Payroll Tax Election

Qualified small businesses use this section to apply the credit against employer payroll taxes.

Follow the instructions line by line. Skipping context often leads to errors later.

Quick Note: An IRS form list is a quick reference guide to commonly used tax forms, helping individuals and businesses find the right documents for filing, reporting income, and staying compliant with tax laws.

How to Calculate ASC vs Regular Method

Choosing the correct method matters.

Regular Credit Method

Uses a fixed-base percentage

Requires extensive historical data

Rarely practical for modern businesses

Alternative Simplified Credit (ASC)

Equals 14 percent of QREs above 50 percent of the prior three-year average

Easier to calculate

Lower documentation burden

When businesses ask how to calculate ASC vs regular method, the answer usually favors ASC. Simplicity reduces risk.

What Documents Are Required?

The IRS expects proof, not promises.

Maintain:

Payroll records and role descriptions

Technical project documentation

Time tracking or reasonable allocation estimates

Invoices for supplies and contractors

Financial records linking expenses to research

Strong documentation also supports better financial habits. Businesses that understand their numbers perform better overall. For insight into this connection, explore:

Financial Literacy Statistics

Documentation builds confidence during audits and clarity during planning.

Can Startups Use the Payroll Offset?

Yes, and this feature remains powerful in 2026.

Qualified small businesses can apply up to $500,000 of the R&D credit against employer payroll taxes.

To qualify:

Gross receipts under $5 million

No gross receipts more than five years ago

Proper election made on Form 6765

This option allows startups to benefit even before turning a profit. Innovation should not wait for taxable income.

What Changed in 2025 and Its Impact in 2026?

The Form 6765 instructions 2025 introduced changes that still shape compliance in 2026.

Key developments include:

Increased emphasis on contemporaneous documentation

Alignment with Section 174 capitalization requirements

Clearer expectations for research narratives

The IRS now expects explanations that reflect actual work performed. Generic descriptions raise questions. Specific details build trust.

Common Errors That Reduce Credits

Avoid these mistakes:

Claiming routine business activities

Overstating wages without role clarity

Ignoring supply substantiation

Missing payroll tax elections

Filing without professional review

Errors do not just reduce credits. They increase scrutiny.

Why Financial Literacy Supports R&D Claims?

Understanding finances improves R&D credit accuracy.

Businesses with strong financial literacy:

Track expenses more clearly

Allocate wages more accurately

Respond better during audits

At BooksMerge, financial clarity guides every service. That approach strengthens compliance and supports sustainable growth.

For expert assistance, call +1-866-513-4656.

Conclusion

Form 6765 rewards innovation when handled correctly.

Understanding Instructions Form 6765 helps businesses claim legitimate credits, reduce tax exposure, and maintain IRS compliance. In 2026, accuracy and documentation matter more than ever.

With the right guidance, the R&D tax credit becomes a growth tool, not a filing headache.

Frequently Asked Questions

1.What is Form 6765 used for?

Form 6765 calculates and claims the federal R&D tax credit for qualified research activities.

2.Who qualifies for R&D tax credit?

Businesses that engage in technical experimentation and problem-solving may qualify, regardless of size or profitability.

3.What are QREs?

QREs include qualified wages, supplies, and contract research costs directly tied to eligible R&D activities.

4.How to calculate ASC vs regular method?

ASC uses recent expense averages and simpler calculations, while the regular method relies on historical data and fixed-base percentages.

5.What documents are required?

Payroll records, technical documentation, project notes, invoices, and financial reports support a valid claim.

6.Can startups use payroll offset?

Yes, eligible startups can apply up to $500,000 of the credit against payroll taxes.

7.What changed in 2025?

The IRS increased documentation expectations and clarity, shaping how businesses approach Form 6765 in 2026.

Read Also: Form 6765 Instructions

Write a comment ...