A W-2 form reports an employee’s annual wages and tax withholdings to the IRS and Social Security. BooksMerge helps ensure accuracy, compliance, and proper filing for individuals and businesses.

If taxes ever felt like a foreign language, the W-2 form might be your first encounter. This document is essential for employees and employers alike, providing a snapshot of annual income, federal and state tax withholdings, and other important financial information.

At BooksMerge, we simplify complex tax forms, ensuring that your W-2 is accurate, compliant, and ready for filing. Our expert team can help you understand what a W2 form is for, how to read it, and why it matters for your financial health. Call +1-866-513-4656 to get professional assistance.

Table of Contents

What is a W-2 Form

The Purpose of a W-2 Form

Who Receives a W-2 Form

Components of a W-2 Form

How a W-2 Form Is Used

Filing Requirements for Employers

W-2 and Taxes: What Employees Should Know

Common Mistakes to Avoid

W-2 Form vs 1099 Form

BooksMerge Tax Services and Pricing Insights

Conclusion

FAQs

1. What is a W-2 Form?

A W-2 form is a tax document provided by employers to employees and the IRS. It details an employee’s annual wages, federal, state, and Social Security taxes withheld, and other key payroll information.

Query integration: What is a W2 form?

In short, it’s a record of income for the year, used to file personal income tax returns accurately.

2. The Purpose of a W-2 Form

The W-2 form ensures both the employee and the government know the total income earned and the taxes withheld. It serves multiple purposes:

Helps employees file federal and state income tax returns

Ensures proper reporting to the IRS and Social Security Administration

Tracks contributions to Medicare and Social Security

Prevents errors in tax payments

Query integration: What is the purpose of a W2 form?

Its primary purpose is to provide an official record of income and tax withholdings for accurate tax reporting.

3. Who Receives a W-2 Form?

Any employee who earns wages from an employer receives a W-2. This includes:

Full-time employees

Part-time employees

Seasonal and temporary workers

Certain government employees

Independent contractors do not receive W-2 forms; they are issued 1099 forms instead.

4. Components of a W-2 Form

A typical W-2 form contains several critical boxes and fields:

Box 1: Wages, tips, and other compensation

Box 2: Federal income tax withheld

Box 3 & 4: Social Security wages and tax withheld

Box 5 & 6: Medicare wages and tax withheld

Box 12: Various codes for benefits or contributions (e.g., retirement plans, adoption assistance)

Box 16 & 17: State wages and taxes

Each section is important for both employees filing taxes and employers reporting payroll.

5. How a W-2 Form Is Used?

Employees use their W-2 forms to:

Complete IRS Form 1040 accurately

Verify withholding amounts match what was deducted during the year

Claim tax credits or refunds

Employers submit copies to the IRS and Social Security Administration to verify reported income. This ensures accurate reporting of federal and state tax obligations.

Query integration: What is a W2 form used for?

The W-2 is used to report wages, calculate taxes owed, and file an individual’s annual tax return.

6. Filing Requirements for Employers

Employers must provide W-2 forms to employees by January 31 each year. They must also file copies with the Social Security Administration and relevant state agencies.

Key requirements include:

Accurate reporting of wages and withheld taxes

Timely submission to employees and government agencies

Corrections for any errors via W-2c forms

Failing to comply can result in fines and penalties, so accuracy is critical.

Tip: IRS tax forms 2025 are the official documents individuals and businesses use to report income, claim deductions and credits, and stay fully compliant with federal tax requirements for the 2025 tax year.

7. W-2 and Taxes: What Employees Should Know

Understanding your W-2 is crucial for filing correctly:

Compare your year-end pay stub to your W-2 for accuracy

Ensure all federal, state, and local tax withholdings are correct

Use the W-2 to claim refunds or pay additional taxes if necessary

Employees should keep copies of W-2s for at least three years in case of audits or discrepancies.

8. Common Mistakes to Avoid

Incorrect Social Security number or employer identification

Mismatched income and withholding amounts

Misreporting tips or bonuses

Losing the W-2 before filing taxes

Filing without all copies of W-2 from multiple employers

Following the instructions carefully prevents delays or IRS notices.

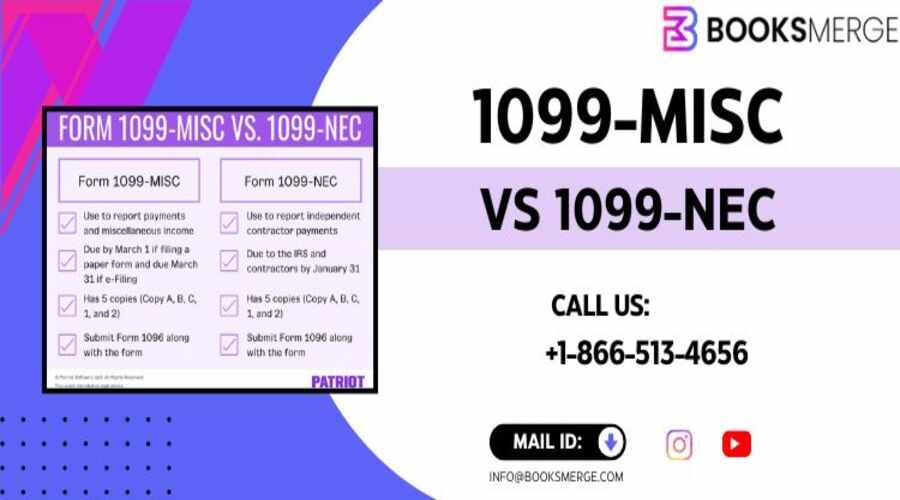

9. W-2 Form vs 1099 Form

It’s important to understand the difference between W-2 and 1099 forms to ensure proper tax reporting:

Employee Type: W-2 forms are for employees, whereas 1099 forms are for independent contractors.

Taxes Withheld: Employers withhold federal, state, Social Security, and Medicare taxes for W-2 employees. Contractors receiving a 1099 handle their own tax payments.

Employer Responsibility: Employers report wages and withholdings on W-2s. For 1099s, they report only the payments made to the contractor.

Filing Requirement: W-2 copies go to both the IRS and the employee. 1099 copies are submitted to the IRS and provided to the contractor.

Using the correct form helps maintain compliance and prevents potential IRS penalties.

10. BooksMerge Tax Services and Pricing Insights

Filing taxes accurately can be daunting. BooksMerge offers transparent tax pricing and professional support for both employees and employers dealing with W-2 forms.

Starter Plan – $179/month:

Basic bookkeeping for small businesses

Payroll and W-2 reporting

Email support with fast responses

Core Plan – $299/month:

Advanced bookkeeping

W-2 and 1099 preparation

Email + limited chat support

Custom Plan – Custom Quote:

Comprehensive tax and payroll services

Dedicated accountant for W-2 accuracy

Priority support via call, email, and chat

Proper tax price planning with BooksMerge ensures compliance and prevents mistakes when filing W-2s. Call +1-866-513-4656 to get started.

11. Conclusion

The W-2 form is more than a piece of paper—it’s a critical document for tax compliance, reporting, and financial planning. Understanding what a W2 tax form is, its purpose, and how to use it properly ensures employees avoid errors, maximize refunds, and remain audit-ready.

BooksMerge simplifies W-2 filing, payroll management, and tax compliance for individuals and businesses. Call +1-866-513-4656 to get professional assistance today.

12. FAQs

What is a W2 form?

It’s a tax document showing an employee’s annual wages and tax withholdings for accurate filing and reporting to the IRS.

What is a W2 tax form used for?

It’s used to file federal and state taxes, calculate owed amounts, and claim refunds or credits.

What is the purpose of a W2 form?

To ensure accurate reporting of wages and taxes for both employees and government agencies.

Who needs a W-2?

Any individual earning wages as an employee from an employer.

What is a W2 form for?

To provide a formal record of income, deductions, and tax withholdings for the year.

How long should I keep a W-2 form?

Employees should retain copies for at least three years for audit purposes.

Read Also: How to fill out a 1040 form

Write a comment ...