Form 6765 instructions guide businesses to claim R&D tax credits, calculate qualified research expenses, and reduce taxes safely while staying compliant with IRS regulations and maximizing savings.

Table of Contents

Introduction to Form 6765

What Is Form 6765 Used For?

Who Qualifies for R&D Tax Credit?

Understanding Qualified Research Expenses (QREs)

Instructions for Form 6765: Step by Step

ASC vs Regular Method: How to Calculate

Payroll Tax Offset for Startups

What Changed in 2025

Common Filing Mistakes

Documentation Requirements

BooksMerge Expertise: Filing Form 6765 with Confidence

Conclusion

FAQs

Introduction to Form 6765

Innovation fuels business growth, but taxes can slow momentum. The IRS Form 6765 exists to reward companies investing in research and development. Following irs form 6765 instructions carefully ensures you claim every eligible credit and reduce tax liability efficiently.

Whether you develop software, improve manufacturing processes, or experiment with new products, Form 6765 opens doors to federal tax credits and, in some cases, payroll offsets. At BooksMerge, we help businesses navigate these credits, combining technical expertise with financial strategy.

What Is Form 6765 Used For?

Form 6765 is the official IRS form for claiming the Research and Development (R&D) tax credit. Businesses use it to:

Report qualified research expenses (QREs)

Calculate the federal R&D tax credit

Offset federal income or payroll taxes if eligible

Essentially, Form 6765 turns innovation into tangible tax savings. Companies investing in product development, software creation, or process improvement can benefit, regardless of size.

Following the IRS Form 6765 instructions ensures your calculations are accurate and credit is maximized.

Who Qualifies for R&D Tax Credit?

Many businesses assume only large tech companies qualify. That’s a misconception. According to IRS guidelines:

Your business must perform activities with technical uncertainty

Activities should rely on engineering, computer science, chemistry, or similar sciences

Research must be conducted primarily in the United States

Substantial documentation and testing are required

From small startups to large manufacturers, companies across industries—including food technology, architecture, and software—often qualify.

Understanding Qualified Research Expenses (QREs)

QREs are at the heart of Form 6765 instructions. They include:

Wages paid to employees performing qualified research

Supplies consumed during research

Contract research expenses (generally 65% of payments)

Certain cloud computing costs tied to development

Non-qualifying expenses include general overhead, marketing, and routine office supplies. Coffee for late-night coding may help your team, but it won’t count as a QRE.

Instructions for Form 6765: Step by Step

Following instructions for Form 6765 prevents errors and maximizes credit.

Step 1: Identify Qualified Activities

Document projects meeting the IRS four-part test: experimentation, uncertainty, process, and technical nature.

Step 2: Calculate QREs

Include wages, supplies, and contract research costs. Keep precise payroll records and financial documentation.

Step 3: Select Credit Method

Choose between Regular Method and Alternative Simplified Credit (ASC) depending on which yields a higher benefit.

Step 4: Complete Form Sections

Section A: Regular credit

Section B: ASC calculation

Section C: Credit limitations

Section D: Payroll tax election (if applicable)

Step 5: Apply Limitations

Apply income and payroll tax limitations to avoid IRS issues.

Step 6: Attach Documentation (If Requested)

The IRS may require supporting documentation. Keep your project notes, technical reports, and payroll allocations ready.

Quick Note: Find and understand every IRS form you need with our complete IRS form list, making tax filing simple for businesses and individuals alike.

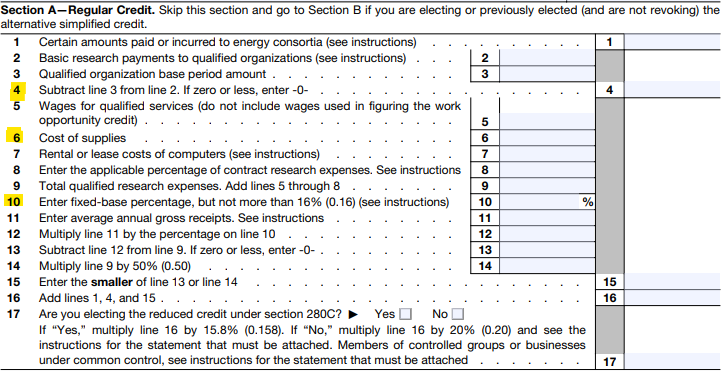

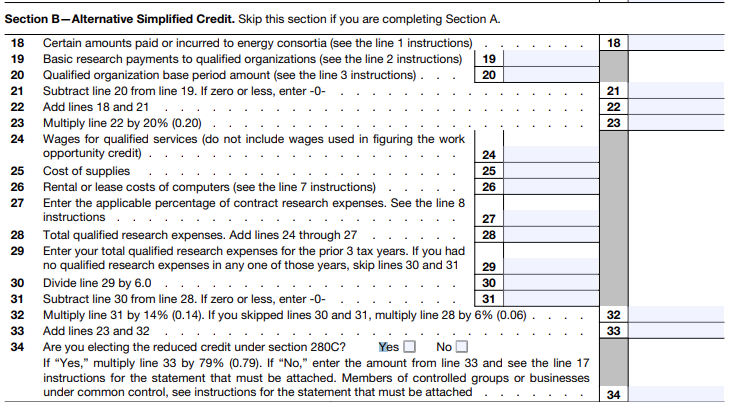

ASC vs Regular Method: How to Calculate

The IRS allows two calculation methods for Form 6765:

Regular Method: Compares current QREs to a historical base period. Often better for older companies with consistent R&D spending.

Alternative Simplified Credit (ASC): 14% of current QREs above 50% of the prior three-year average. Many small businesses prefer ASC due to simplicity.

Choosing the correct method ensures maximum savings without risking IRS adjustments.

Payroll Tax Offset for Startups

Startups can use R&D credits to reduce payroll taxes. The IRS allows:

Eligible businesses with gross receipts under $5 million

Application of up to $500,000 credit against employer payroll taxes

This option provides critical cash flow before profitability, helping small innovators survive and thrive.

What Changed in 2025?

Form 6765 instructions 2025 updated IRS expectations for compliance:

Emphasis on detailed project descriptions

Stronger scrutiny of wage allocations

Alignment with Section 174 capitalization rules

Vague documentation or missing technical details can lead to denied credits or audits.

Common Filing Mistakes

Avoid these mistakes when following Form 6765 instructions:

Overstating or misclassifying QREs

Skipping payroll allocations or required documentation

Selecting the wrong credit calculation method

Failing to describe projects clearly

Accuracy trumps speed—mistakes cost refunds and increase audit risk.

Documentation Requirements

Keep clear and organized records for IRS review:

Payroll reports and W-2 allocations

Project timelines and detailed descriptions

Technical notes and test results

Financial statements linking expenses to research

Well-maintained documentation builds credibility and ensures audit readiness.

BooksMerge Expertise: Filing Form 6765 with Confidence

At BooksMerge, we help businesses navigate irs form 6765 instructions efficiently. From R&D credit studies to payroll offsets, our experts ensure accuracy, compliance, and maximized savings.

Call +1-866-513-4656 today to work with professionals who understand both business innovation and tax compliance.

For small business financial insights, check our guide on financial literacy statistics to understand how knowledge impacts growth.

Conclusion

Form 6765 instructions may seem complex, but with careful documentation, the right method, and professional guidance, businesses can unlock substantial R&D credits. Following IRS guidance accurately not only saves money but builds trust and compliance.

FAQs

What is Form 6765 used for?

It claims the federal R&D tax credit and reports qualified research expenses to the IRS.

Who qualifies for R&D tax credit?

Businesses conducting experimental or innovative work in the U.S. across various industries.

What are QREs?

Qualified Research Expenses include wages, supplies, and contract research costs related to R&D.

How to calculate ASC vs regular method?

The regular method uses a historical base, while ASC compares to a three-year average. Choose the higher credit.

What documents are required?

Payroll records, project descriptions, technical notes, and financial statements to support the credit.

Can startups use payroll offset?

Yes, eligible startups can offset up to $500,000 of employer payroll taxes using the R&D credit.

What changed in 2025?

More detailed project descriptions, stricter wage allocations, and alignment with Section 174 rules.

Read Also: Form 6765 Instructions

Write a comment ...