Form 1040 is the IRS tax form used by U.S. individuals to report income, calculate taxes owed, and claim credits or deductions. Proper completion ensures compliance and potential refunds.

Filing taxes can feel like decoding a secret language, but with the right instructions, even a first-time filer can complete an IRS 1040 form confidently. BooksMerge helps taxpayers navigate Form 1040 and related schedules, ensuring accurate filing, maximum deductions, and a stress-free process. Call +1-866-513-4656 for expert guidance.

Table of Contents

What is a 1040 Tax Form?

Who Needs to File Form 1040?

Gather Your Documents

Step 1: Personal Information

Step 2: Filing Status

Step 3: Income Section

Step 4: Adjustments to Income

Step 5: Tax and Credits

Step 6: Other Taxes

Step 7: Payments and Refund

Step 8: Sign and Submit

Form 1040 Schedules Overview

Completed 1040 Form Example – PDF

Tax Price Insight

BooksMerge Support and Tips

FAQs

1. What is a 1040 Tax Form?

IRS Form 1040 is the standard individual income tax return form used in the United States. It helps you:

Report income from wages, investments, or business activities

Claim deductions and credits

Calculate total tax owed or refund due

If you are unsure how to fill out a 1040 form, following clear step-by-step instructions ensures accuracy, avoids penalties, and maximizes potential refunds. Other variants exist, including the 1040-NR form for nonresident aliens. Completing it correctly is essential for smooth filing and compliance with IRS requirements.

2. Who Needs to File Form 1040?

Generally, U.S. citizens and residents with income above certain thresholds must file Form 1040. You also need to file if:

You are self-employed

You received dividends or capital gains

You qualify for tax credits or deductions

Using the correct form ensures compliance with the IRS and can help optimize your tax price.

3. Gather Your Documents

Before you start, collect:

W-2 forms from employers

1099 forms for freelance or investment income

Mortgage interest statements

Charitable donation receipts

Social Security or other benefits documents

Having all documentation ready makes filling out Form 1040 faster and reduces errors.

Step 1: Personal Information

Provide:

Name and Social Security number

Spouse information if filing jointly

Address and contact details

This ensures your tax return is linked correctly to your IRS record.

Step 2: Filing Status

Select one of the following:

Single

Married Filing Jointly

Married Filing Separately

Head of Household

Qualifying Widow(er)

Your filing status affects your standard deduction and tax rates.

Step 3: Income Section

Report all sources of income:

Wages (W-2)

Interest and dividends (including Schedule B Form 1040)

Capital gains

Business income

Other income types (rental, unemployment, etc.)

Accurate reporting here is essential to avoid audits.

Step 4: Adjustments to Income

Adjustments can reduce your taxable income. Include:

Student loan interest

Retirement contributions

Health savings account contributions

These adjustments appear on the Form 1040 schedule 3 if applicable.

Step 5: Tax and Credits

Calculate your tax owed using IRS tables. Claim applicable credits:

Child tax credit

Education credits

Retirement savings contributions credit

Credits reduce your tax liability and may increase refunds.

Step 6: Other Taxes

Include:

Self-employment tax

Additional Medicare tax

Household employment taxes

Ensure you complete this section carefully to avoid underpayment.

Step 7: Payments and Refund

Report payments already made:

Federal income tax withheld from W-2

Estimated tax payments

Excess Social Security tax withheld

This section calculates whether you owe the IRS or are eligible for a refund.

Step 8: Sign and Submit

Sign the return

Include spouse signature if applicable

Date the return

You can file electronically or by mail. Electronic filing speeds processing and refund issuance.

Quick Tip: The IRS form list is a complete directory of official tax forms and schedules used by individuals and businesses to report income, claim deductions, and stay compliant with U.S. tax laws.

4. Form 1040 Schedules Overview

Some taxpayers will need additional schedules:

Schedule 1: Additional income or adjustments

Schedule 2: Tax on certain types of income

Schedule 3: Nonrefundable credits

Schedule B: Interest and dividend income

Schedule C/D/E: Business, capital gains, or rental income

Correct schedule usage ensures accurate reporting and maximizes deductions.

5. Tax Price Insight

Filing taxes accurately affects your tax price. Using professional services or guidance like BooksMerge can help optimize deductions and credits, ensuring you don’t overpay while remaining fully compliant.

6. BooksMerge Support and Tips

BooksMerge helps with:

Accurate Form 1040 completion

Proper use of schedules

Maximizing eligible credits and deductions

Reducing IRS audit risk

Call +1-866-513-4656 to consult with experts who simplify tax filing while saving money.

7. FAQs

1. What is 1040 tax form?

Form 1040 is the standard individual tax return form for reporting income, claiming deductions, and calculating taxes owed or refunds.

2. What is a 1040-NR form?

The 1040-NR form is for nonresident aliens to report U.S. income.

3. How do I use Form 1040 schedule 3?

Schedule 3 is used for reporting nonrefundable credits like education or retirement contributions that reduce tax liability.

4. What is Schedule B Form 1040?

Schedule B reports interest and dividend income if it exceeds certain amounts or comes from multiple sources.

5. Where can I see a completed 1040 form example – PDF?

The IRS provides sample PDFs, and BooksMerge can guide you through reference examples for better accuracy.

6. Can I reduce my tax price by filing correctly?

Yes. Accurate completion, deductions, and credits reduce your tax price, ensuring compliance and optimizing refunds.

7. Who can help me fill out a 1040 form?

Experts like BooksMerge provide step-by-step guidance, schedule usage, and professional support for all taxpayers.

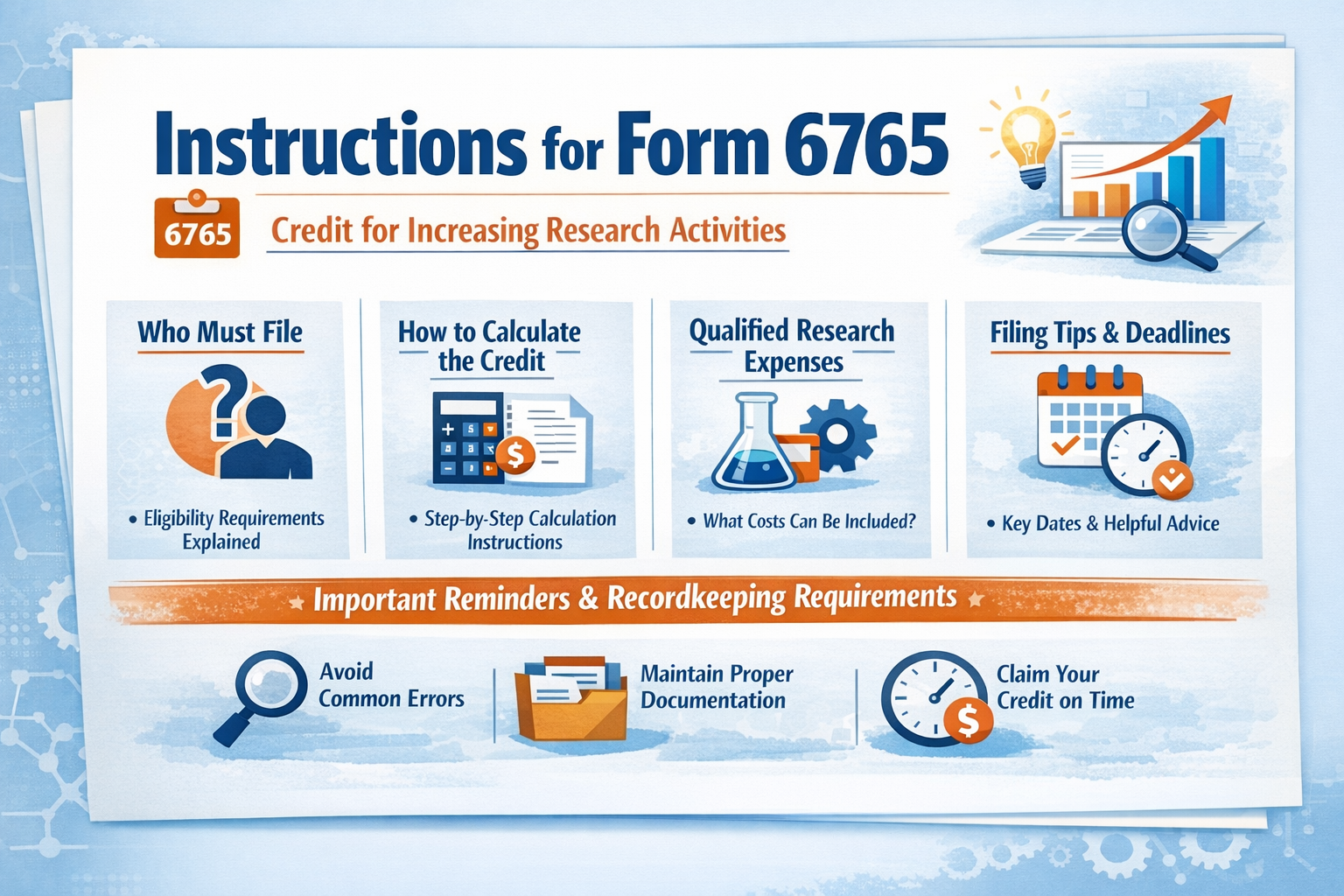

Read Also: Form 6765 Instructions

Write a comment ...